| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

April 2021

Subex’s New HyperSense AI-Platform Aims to Turn Telcos into Agile, Analytics-Driven Ubers and Rakutens

Certain functions of telecom IT, such as consumer billing and charging, are fairly consistent across carriers. That’s why you see solution vendors like Ericsson, CSG, and Amdocs earn billions of dollars serving telcos in those areas.

And yet there are dozens of telecom IT areas where merchant vendors struggle to gain traction. This is especially so in places where the legacy system embeds unique rules or where a major transformation would require retraining thousands of people.

Former Verizon CIO, Fari Ebrahimi, tells the story of how his team once spent an enormous sum developing customer care GUIs for agents across the company. But during final testing, they discovered the color visuals in the GUIs could not be interpreted by a large percentage of care agents. The problem? The agents were color-blind!

But despite its immense challenges, there’s great telco interest today in DevOps and Do-It-Yourself builds. And it’s because technology has evolved to empower it: things like agile software, clouds, and being able to order gigabits of bandwidth on-demand.

However, there is a systems path that delivers over-the-top value to telecom IT and the business without the pain of disrupting telco operations, processes, or people.

It's called AI/analytics, and its power is to provide an intelligent overlay to hundreds of scattered, multi-vendor BSS/OSS, assurance, and network systems.

By enabling better decision-making at all levels — executive to customer care agent — AI/analytics will: improve the customer experience; boost efficiency; speed up network repairs; plug revenue leaks; and close fraud/security holes.

And although telcos aim to flex their Build-in-House muscles, they also realize they can’t do AI/analytics alone. A sharing of responsibilities is key. And it’s here where Raghuram Velega, VP of Big Data and Analytics at Jio, offers some straightforward advice to solution vendors. . .

And by that he means: telco and developers should work together: if a vendor can perform a certain Extract, Transform, and Load (ETL) job much faster, well, maybe that’s a great task to offload to the vendor.

So telcos’ desire to work more cooperatively with analytics/AI vendors will drive a lot of future business. The great challenge for the vendor, then, is to build a framework to enable such cooperation and task sharing — to strike the perfect balance.

Well, Subex has just delivered such a framework. It’s called HyperSense and it’s the successor to the decade-old ROC platform Subex built its worldwide reputation around.

And here to explain the new platform’s mission and its many forward-looking virtues is Rohit Maheshwari, Head of Products and a key systems architect at Subex.

In our discussion, Rohit puts HyperSense into context. He first explains why telcos must swiftly adopt the pervasive AI/analytics methods that have made hyperscalers so successful. He then gives examples of where cross-company data sharing at a telco can make a difference. Finally, he highlights the 12 key features of the platform that address new tech innovations, openness, and agile capabilities the industry is looking for.

| Dan Baker, Editor, Black Swan Telecom Journal: Rohit, sounds like you’ve been thinking a lot about where telecom is headed. And designing a framework for the future of telco AI and analytics: that’s a mighty tall order. Congratulations on the launch of HyperSense. |

Rohit Maheshwari: Thanks, Dan. Actually, for the last couple of years I’ve been a student on the hyperscalers. I’ve been studying how digital giants like Facebook, Amazon, and Google use data to operate their businesses.

And what these companies seem to do better than everyone else is exploit their data and information services across their organizations. They are able to extract the features of their raw data so all parts of the organization can use it.

And to accomplish that, they standardize ways to store, catalog, and index their data to enable an AI case or web service to be shared by different functions of the business.

Ever wonder how AI practitioners spend most of their work hours each day? Studies show they spend an enormous 60% to 70% of their time on extracting features, basically turning sets of data into programming objects so they can easily be used in decision-making apps created by their colleagues across the business.

So the internet age hyperscalers know the value of feature extraction and the benefits of knowing how to build once and use many times.

Imagine if the top players at Uber’s data science team suddenly left the company. Uber’s stock price would surely drop the next day.

But if top data scientists at a telco were to leave, the stock market investors probably wouldn’t worry because they know a telco’s data is simply not leveraged so intensely.

You have to ask yourself: why are there no hyperscalers in telecom?

| It’s a bit of an unfair comparison, isn’t it? Uber operates an almost pure virtual business. They own neither physical stores nor taxis. They don’t even employ the drivers. Telco is very different. You have to maintain legacy infrastructure and hire people to deal with the ugliness of physical equipment and outside plant, then you automate as much as you can. |

Absolutely, telco is a vastly different business. But at the same time, telcos must act boldly to adopt the IT practices of the hyperscalers, otherwise the long term competitiveness of telco is in danger.

Look at what Rakuten is doing. They are the leading e-commerce company in Japan and their presence in the mobile telecom business is impressive. Today they are implementing a private 5G network and have quickly moved into 4th place in Japan’s mobile market. [See profile below].

To me, Rakuten is a wake-up call for telcos. To compete against such agile, hyperscaler firms requires adopting radical change in the way we do IT. The future belongs to telcos who build themselves around data and make sure data is at the center of every decision.

This goes far beyond strategic decisions, by the way. A lot of energy has already been put into delivering decision data to top executives. I’m talking about expanding to operational decisions: making sure telcos have access to AI and analytics intelligence to drive decisions across sales and marketing, network operations, finance, assurance, fraud, contracts, HR, and recruiting.

| So how’s telecom doing today? Where is the industry on the road to an AI-rich business and true cross-functional use of its analytic data? |

To be honest, Dan, telcos have only just begun. So far there’s been a series of AI proof-of-concept initiatives in areas like customer segmentation, precision marketing, next best offer, and network optimization.

The biggest area where telcos need to catch up is in building a cohesive data infrastructure or fabric for AI and cross-functional data sharing.

At cloud-scale companies, they have access to the latest and greatest web services because their business stack is built in the cloud. An AWS marketplace or Azure will have many services for voice, natural language processing, etc. These are either open source, sold by the platform suppliers themselves, or brought in my third party players.

Typical telco infrastructure involves on-premise IT infrastructure, network, and different OSS systems on top. Typically you have multiple BSS systems supporting it — some for consumer, some for business, some for mobile, etc.

Similarly, enterprise systems — fraud management, revenue assurance, HR management — have attempted to consolidate data and BI in data lakes programs, but there are different BI data lakes for BSS, OSS, and one for marketing etc.

The challenge is these systems are siloed. They do not talk to each other in realtime. Plus there are no easily accessible AI services, nor are the feature stores and data being organized for easy access.

Many systems are rigid and vendor IP locked. If I want to extract a new piece of information as a telco, I often need to go back to the vendor and issue a change request.

| What are some examples of leveraging analytics across departments? |

Well, one obvious example is sharing voice call data, such the number of voice minutes a person consumes each month.

That info is extremely valuable to product marketing when it comes to pricing new voice bundles or doing promotions. Likewise, that same voice usage data also benefits credit scoring and fraud management.

Here’s an unusual one, but one that will soon become commonplace — using drones for outside plant asset tracking/monitoring.

Telcos maintain all sorts of outside equipment on telephone poles, microwave sites, and cell towers. And it’s very expensive to put skilled technicians and trucks on the road to check on that equipment or climb cell towers.

And there’s a great deal of commonality to using drones. So it makes sense to create and share a drone web service for use by finance asset tracking, network planning, network operations, and so forth.

So what’s required is turn the use of drones and the data drones collect into features or objects than other applications and departments can leverage.

Fraud management is another area AI and features extraction can take to the next level. Today, if I want to predict fraud on an on-line channel, I might be tracking 200 to 300 different features on every transaction.

That would include analysis of the whole journey for a consumer coming on an on-line platform or a mobile app, the time the user spends on each screen, the mouse and keyboard movements, and the behaviors of filling in credit card information in an on-line form.

So the idea is to constantly score the risk of any on-line transaction.

| Can you give us some highlights of the functionality HyperSense brings to the table? |

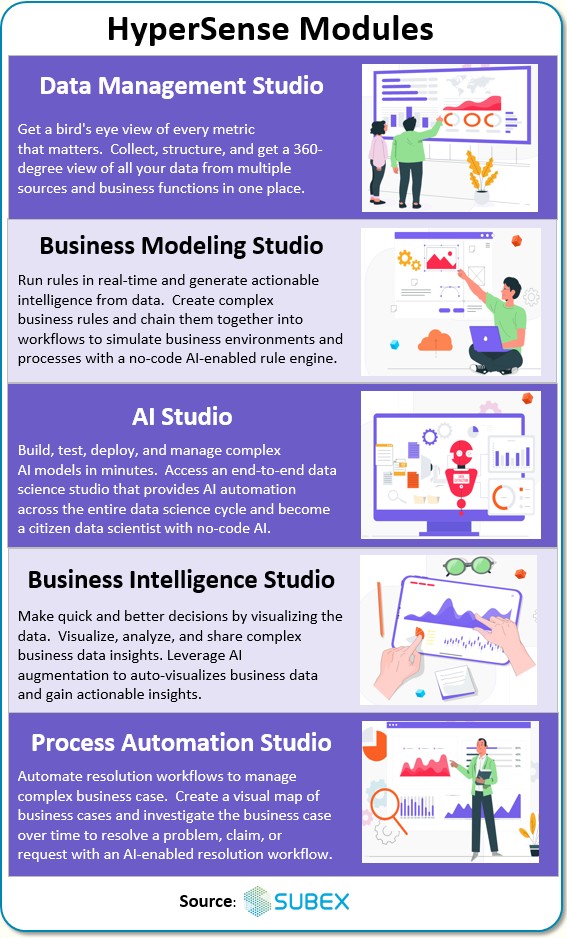

Yes, Dan. HyperSense is a true horizontal platform which cuts across every telco function and enables AI-driven analytics. It’s designed specifically to deliver AI-driven decision analytics, and its key features are:

- Open source components are used throughout the platform allowing us to

be more agile in blending in future applications and IT paradigms.

- Cloud-native capability allows it be deployed on-premises or in the cloud,

meaning it has high scalability to go up or down.

- Micro-Services Architecture — HyperSense is built using micro-services.

Each of those micro-services will allow you to constantly update and do rolling

upgrades without friction.

- Multi-Solution Integration — This is a very big differentiator.

Today a telco wanting to build an integrated, cohesive set of capabilities would need to go to several different vendors and assemble each of these tools

and create a data lake.

Think of it as the engine of a car that brings together dozens of components. The real challenge is figuring out how to make those components sit together and work together.

Subex is doing that hard integration work for the telcos and putting it together in a very cohesive fashion. That’s our vision.

- Many Built-In AI and ML Services — As you’d expect the HyperSense

will include Machine Language use cases in fraud, margin, and business assurance.

We also plan on having AI vision services, language AI services, robotic process

automation, and forecasting. And all these services will lend themselves

to different use cases.

- Third Party Apps Extensible — Certainly all the current Subex applications

will be available on the platform, but the platform is also extensible to use

cases which are beyond Subex’s IP.

For example, if Subex doesn’t have a play in marketing automation, and the telco wants to bring a marketing automation on top of it, they can have Subex build it, or they can build it themselves. So it is truly a DIY platform.

- Flexible Business Model — We can deploy it inside the telco on

their private cloud. And there, telcos can decide how they want to use

it. Alternatively, if it’s deployed in the public cloud as a multi-tenant

platform, then Subex can have the access and responsibility to keep the IT engine

running.

What the telco does on the front end is completely their choice. In that case, it becomes a kind of SalesForce.com — a multi-tenant cloud platform which is managed and maintained by SalesForce, but what you do as a business with the tool is completely up to you.

- Progressive Deployment — The journey could be a sweeping, transformational

one for the telco. Or it could be implemented step-by-step in agile-fashion.

All this is made possible by the micro-services architecture. It can be brought in really small, but also can scale to all-pervasive. The platform will also be available as a SaaS solution.

- Build or Buy — The telcos can buy packaged applications or build

bespoke use cases on the platform.

- Elastic platform — It’s cloud native and so can be built

on small commodity boxes and can be expanded to true telco scale with terabytes

and petabytes of data.

- Agile because it’s built on open source components. So as

the open source community moves the needle, you realize those benefits.

- Democratized Data Science — While the system supports the work

of human data scientists and Machine Learning decision-making, it also democratizes

data science. An application studio enables telcos to build their own

use cases.

| It’s a great vision. I guess the real test will be how well HyperSense adapts to the needs of 5G and other advanced services. |

I think the point is to be ready for any next generation network — 5G or whatever else comes along.

Certainly the most significant innovation 5G brings is the virtualized network. 5G and advanced IoT will require resources be dynamically assigned to a network slice, with each slice guaranteeing a QoS for upload and download, bitrates, latency, etc.

So from a data structure perspective, things will dramatically change.

You’ll also see BSS/OSS transformed into a micro-services driven, cloud native architecture which talks to other BSS/OSS components over APIs.

Now to monitor that experience and make changes in real-time will require tons of AI data and feature engineering information extraction.

So HyperSense will take telcos down that path. It provides a framework for defining the feature engineering and feature stores needed to properly monitor and deliver a robust 5G customer experience.

|

Rohit, thanks for this nice briefing. What you’ve laid out here

is a real call to action. And I agree with your assessment: telcos need to step up their game or the business will suffer. And since Subex is one of the top three telecom analytics platform providers in the market, HyperSense is a true paradigm shift to a more open, AI-based, cloud-friendly, and inter-departmental style of extracting analytics value for telcos. Good luck in rolling this out. |

Thanks, Dan. Another way to look at the HyperSense: it’s an operating system of AI-driven decision analytics at a telco.

Will AI feature engineering dominate telecom analytics in 5 years’ time? We don’t know. And frankly we should simply aspire to inject as much AI as we can to face the serious industry challenges ahead.

I’m extremely excited about what we’re building. And the CIOs and telco leaders I talk to are resonating to this concept. People appreciate what we are building and recognize it as a logical next step in the evolution of decision-analytics for telcos.

Copyright 2021 Black Swan Telecom Journal

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum