| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

September 2020

Subex’s IDcentral Monetizes Telco & Enterprise Data to Deliver Digital ID & Risk Metric Services for Financing, KYC & More

“The mind acts to bring things from where they abound to where they are

wanted; in wise combining. The art of getting rich consists not in industry,

much less in saving, but in a better order, in timeliness, in being at the right

spot. . .

Steam is no stronger now than it was a hundred years ago; but is put to better

use. A clever fellow was aware of the expansive force of steam; he also

saw the wealth of wheat and grass rotting in Michigan. Then he cunningly

screws on a steam-pipe to the wheat-crop. Puff now, O Steam! The

steam puffs and expands as before, but this time it is dragging all Michigan

on its back to hungry New York and England.

Coal lay in layers under the ground for centuries until a laborer with pick

and pulley brought it to the surface. We may well call it black diamonds

for every basket of coal represents power and civilization. Coal is also

a portable climate that carries the heat of the tropics to cold regions.

Coal carries coal, by rail and by boat, to make Canada as warm as Calcutta.”

Ralph W. Emerson, Wealth (1860)

Coal-powered steam engines were a boon to 19th century American commerce, for they enabled steamboats to travel up and down the great Mississippi River. Decades later, the steamboats ultimately gave way to the railroads — also powered by coal.

So here’s the question: what cheap and plentiful “fuel” of commerce is the 21st century’s equivalent of coal?

How about digital consumer intelligence. This data is captured by millions of merchants around the world who use it for their own transactions and customer analytics. But very rarely is that intelligence further monetized to third parties.

Yes, certain companies do successfully leverage other firms’ consumer intelligence, especially the large credit service bureaus and the digital/e-commerce giants. Yet except for these digital-savvy firms, consumer intelligence is vastly under-utilized and just sits there — in the cloud, data warehouses, data centers, etc. — where it lies in wait hoping an entrepreneur will come along with a plan to take that intelligence to market.

This is exactly what Subex is doing with its new IDcentral, a new digital intelligence service that monetizes the idle data of enterprises while also earning a good return for the owner of the data.

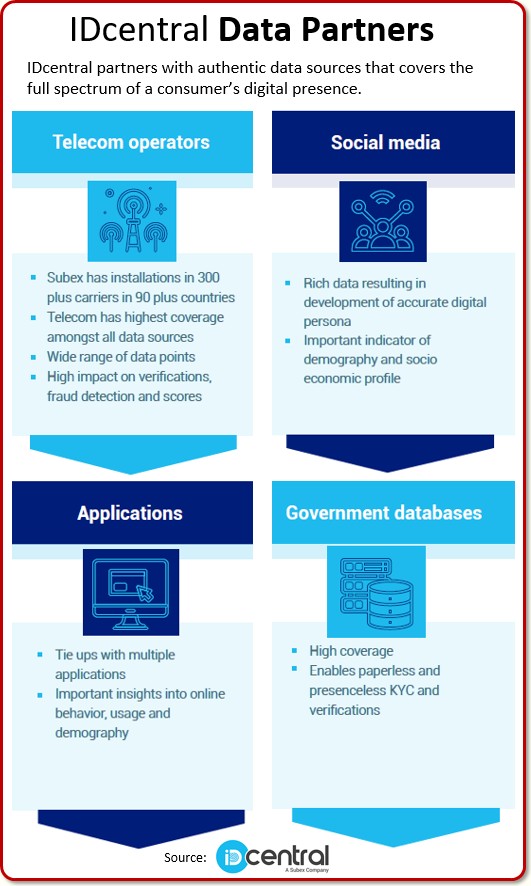

And as you might expect, chief among the enterprises Subex partners are the telcos, the firms Subex has worked closely with for decades. And telcos own a gold mine of customer intelligence embedded in the daily traffic they collect across mobile phones, internet, geo-location, and other sources.

Joining us to discuss this business venture is Shankar Roddam, COO of Subex and Upal Pradhan, AVP — Business Development of IDCentral. Our discussion covers the key value proposition, specific use cases in fast-growing digital regions of the world, and the challenges of delivering a service that requires great partnering and technical expertise.

| Dan Baker, Editor, Black Swan Telecom Journal: Shankar, congratulation to you and all Subexians for carving out a market for this innovative IDcentral service. What’s the main value proposition here? |

Shankar Roddam: Dan, with people all over the world buying on-line or using mobile phones, a vast amount of customer intelligence is available. The challenge is to find efficient ways to harvest it for the greater good of Digital Society.

For instance, governments and regulators around the world have assembled sophisticated data sets — such as national or provincial/state databases. But by itself, the value of such data is somewhat limited. However, if you can combine that data with other intelligence sources like telco data, great value can be created for private and public organizations.

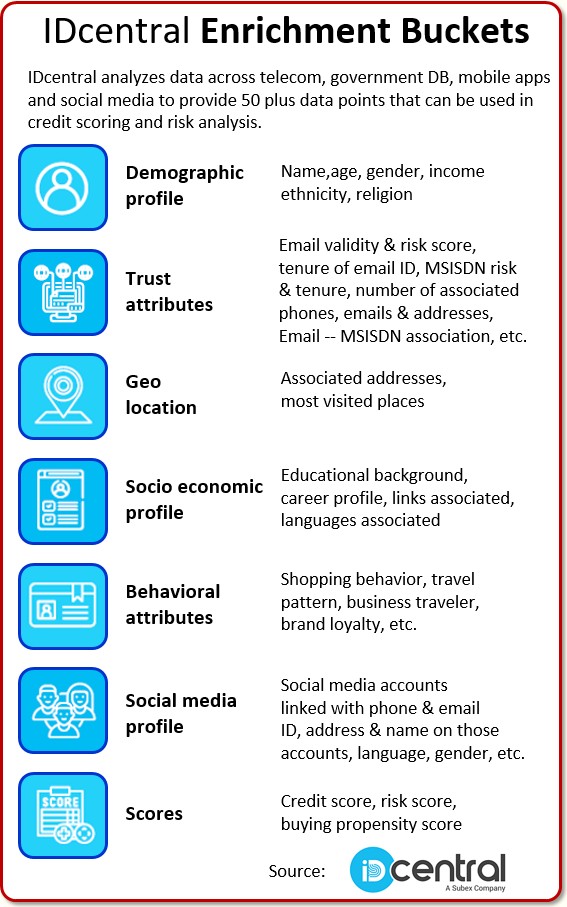

So that’s what IDcentral is all about — packaging up identity information so it can be easily consumed for specific use cases. Such identity intelligence is a significant game changer because it allows enterprises to make smart decisions and lower their risks as they invest for their growth.

| So how does Subex add value in pulling these digital intelligence sources together? |

Well, let me briefly explain what we aspire to do and what we are aiming to be.

We aim to be a kind of marketplace of different data sets that would serve customer validation/verification or other use cases in a fairly seamless way.

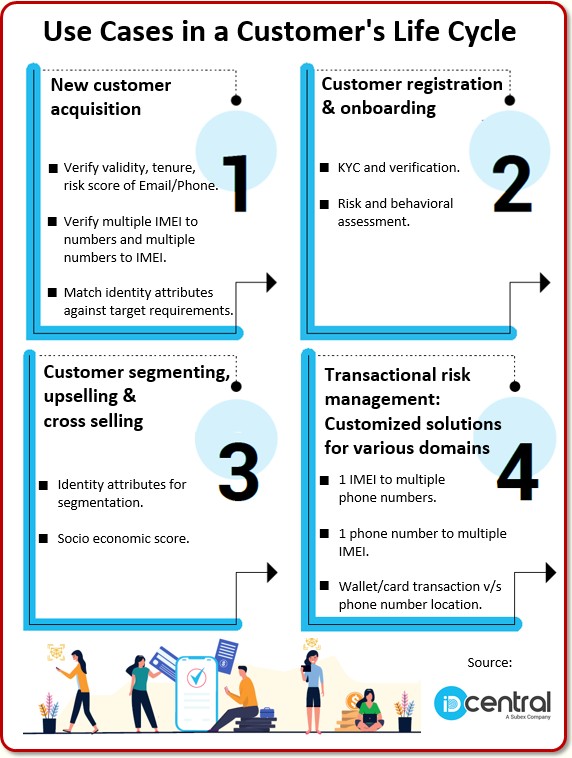

Validation/verification makes up a big part of the use cases in IDcentral, but obviously we are also talking to customers who want help with their customer onboarding process.

For instance, we are engaged with a bank and a telco to enable the bank to offer certain financing products and methods based on the data the telco has. There are benefits here for both sides: the telco gets to offer its data as a service, and the bank benefits from growing a micro financing business.

Now in each of these identity cases, IDcentral has a significant role to play. Essentially we are taking a telco or other enterprise’s verifications and validations to solve specific business problems.

To create these services, we first pull together vast numbers of data sources and digitize them. These data — many of them in paper form — we pull in from various government, social sources, and the like. Then we also insert telecom data.

And by adding in telco data we bring something new to the table. Telcos have always had a huge amount of customer specific data — probably more than any other industry. And that’s where the opportunity lies: leveraging the telco data to provide meaningful inputs for a business enterprise.

| In what regions of the world is this digital intelligence most in demand? |

Well the creation of these digital intelligence services is certainly an opportunity for countries everywhere.

But the developing markets are a bigger opportunity today simply because the rate of digital adoption is much higher in these markets.

In fact, the rate of digital adoption is a more critical factor of success, say, than having a large population in the country.

The U.S. market is stable and lots of datasets are available. That’s a more predictable market and established processes are in place. But in the developing markets, the number of unknowns is higher. So if that market has high digital adoption, then that’s a big opportunity.

Countries like the Philippines, Indonesia, and India of course are rich marketplaces for these digital verification and data services.

A couple countries in Africa are having a huge uptick. If you look at the mobile money brand M-PESA, there’s a very good reason it succeeded so much better in Africa than in other countries.

Upal Pradhan: To add to that, Dan, the credit gap that exists in developing countries — the amount of credit that could be put to good use by micro- and small-sized businesses — is worth an estimated $2 trillion dollars.

A big problem in developing countries is a large percent of the population doesn’t have a postal or zip code. Another key factor is many people have no formal education nor a formal job with a company who prepares employment documents.

So the digital data works as a proxy for the conventional documentation used by financial and insurance forms.

For example, whenever someone is going to get a loan, it’s natural that they prove their address by supplying a rental agreement or a national ID. But these often don’t exist in these countries.

However, telco data is a very good proxy for the address. And it can be argued, in fact, that it is more accurate than any physical address record.

So whenever someone is obtaining a loan, this information is matched and it has a huge lift on lowering the loan default risk. Banks are far more comfortable when there’s a match-up with an address from the telco.

And in M-PESA in Kenya, they have used such verification and are processing a huge number of applicants for micro financing. So telco data is an excellent proxy for conventional data.

And micro financing is merely one use case of many.

| Let’s talk about micro financing. How do you address that specific problem with the IDcentral? |

Shankar Roddam: Well, there are many commercial models in micro financing. One way micro financing is enabled is Online lending.

The problem we are solving here is worth hundreds of millions of dollars. Two kinds of customer intelligence generally go together to make micro-financing decisions: 1) credit worthiness, and 2) intelligence on the type of financial product that best fits a particular customer.

Less than 30 % of the population in developing economies have conventional credit score and hence are unable to access formal credit. IDcentral, using digital footprint, evaluates the credit worthiness of these individuals and enables them to access credit which is essential for this segment.

Secondly — and just as important — we must select the product that’s most useful to the customer. Our buying propensity algorithms enable lenders to determine the product that best fits the customer’s need as well as risk profile.

Essentially, you’re trying to digitally replicate the role of a sales agent in person-to-person store or phone sales. A good salesperson in a retail store, for example, is not just ringing up the sale and answering simple questions. If it’s a complex sales, the salesperson should also:

- Show the customer the range of product offerings;

- Steer the customer to suitable products, and also;

- Gather some intelligence about the customer and his possible future needs.

It’s quite a challenge to do that digitally, but that’s what we’re creating value to drive financial inclusion.

| Telcos have been reluctant to utilize their data for security reasons and not having the right business model. |

Yes, it’s true. In fact, I was talking to an exec at one of our customer sponsors and he said, “I was tasked one time with the ability to geo-locate our mobile customers. The project was a success, but the bigger challenge for us was figuring out: what do I do with that ability?”

So that’s the story of telco — having a lot of data, but not knowing how to properly monetize it.

| What are the hurdles to this IDcentral business? Is technology holding you back? Are there data access problems? |

Well, if you look at what’s happening in the telco stack, they are increasingly becoming more API-driven. Most of the telcos are ready to support these services. Technologies, in my view, are actually the least of the barriers.

And we are seeing increased openness from telcos. In fact, the COVID pandemic has helped push digital services along. They are even more ready to invest now as long as there’s a solid use case.

Regulators have relaxed some restrictions, too. Same goes for security and healthcare. They are all opening up for more digital interactions and business. We think now’s a perfect time for this to take off.

| Seems like demand for these services should have taken off a few years ago. |

Yes, some companies have tried to get into the market, but regulations such as the GDPR hurt them.

A lot of folks tried to make a business out of taking the telco data out. One of the major credit service bureaus, for example, tried to work with telcos on this but were not successful.

So more than anything else, success is hinged on driving a specific revenue opportunity for telcos.

Many of the organizations we are talking about — banks, insurance companies, etc. — have felt customer ID intelligence was not sufficient for them over the last several years. And they have been seeking ways to use telco data, but since these firms don’t specialize in telco data, they could not move forward.

So that’s a big advantage we have at Subex, especially since telco data is one of the critical pieces they need. This is a big differentiator for us. When we approach a telco, we speak their data language. As a result we get much easier access to the data.

And we’re already processing telco data through our systems which monitor fraud and security for telco clients around the world, and several tier one carriers. So this background of serving telcos for 20+ years gives us credibility.

Another trend pushing these identity services is partnerships between telco and others. In some cases, telcos partner with retailers. Retail folks have sought to get telco licenses, such as Tesco in the UK.

Likewise, telcos are buying digital banking licenses — or offering mobile money systems like Safaricom’s M-PESA. So the world is changing and the divide between different industries is getting thinner. So more and more businesses are looking to collaborate with other industries and domains.

| How useful is IDcentral in a customer onboarding or Know Your Customer (KYC) use case? |

Upal Pradhan: There many market-proven uses for IDcentral’s use in customer onboarding. For instance, we can use the telco data to create a credit score.

Consider the universal problem of a consumer ordering something for the first time in an e-commerce transaction or mobile wallet platform.

Well, one of mandatory documents are government documents such as a driver’s license: the rental car or motorbike firms are required to check the license.

The conventional method was to submit a photocopy of the government document. And maybe submit a selfie photo where a person in the back office compares the pictures.

Subex is taking that screening activity to the next level. When the merchant needs the driver’s license number for the person, we can produce the document from our data — and deliver it in real-time. Also, no OCR is required, and it’s far more cost effective and efficient because the person doesn’t have to take a photo.

More importantly, delivering a government record is more secure, whereas a physical driver’s license or national ID card can be easily faked or Photoshopped.

But with our backend database, we simply find the national documents on file and match the address. Another benefit is our service is “document-less”, so the person being ID’ed doesn’t need to carry a document as long as he or she has the number.

This capability is applicable for any monetary transaction: the opening of a bank account, registering on an e-commerce website, it using an on-line service like Air B&B. Generally, any place where Know Your Customer documentation is required.

| Shankar and Upal, thanks for this fine briefing. I certainly think Subex is onto something big here. Good luck on the continued roll-out of IDcentral. Look forward to getting updates on your progress. |

Copyright 2020 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum