| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

February 2013

Decom Dilemma: Why Tearing Down Networks is Often Harder than Deploying Them

The rate of technology change in today’s telecom networks is massive. And in our haste to deploy new 4G LTE and IP-based infrastructure we often forget that for every new technology we deploy, there’s typically a legacy network that’s been rendered obsolete and needs to be taken out of service.

The irony is that operators have gotten good at rapidly deploying new technologies, but they’ve generally not taken the time to figure out the best ways to decommission legacy networks on a large scale. As a result, a small cadre of industry experts have emerged to help advise carriers and support the management of complex program investments in this vital area.

One of the experts in Network Decommissioning is Dan Hays, the U.S. Wireless Services Advisory Leader at PwC. And in my discussion with Dan below, he explains the many complexities involved and strategies his firm uses to unwind decades-old legacy networks in an efficient and effective way.

| Dan Baker: To start off, Dan, I wonder if you could refresh us on PwC’s business and how you’re involved in the grand scheme of decommissioning things. |

Dan Hays: Sure, Dan. Well, PwC is currently the world’s largest professional services network and we have three primary lines of business. First, there’s what we call “assurance” and that’s our traditional accounting and audit capabilities. Second we help companies optimize their tax strategies and manage liabilities, and finally we have an “advisory” business that does consulting and that’s what I’m part of.

We work with telecom clients on network decommissioning in many capacities. For instance, several of our clients have asked us to help them plan their network decommissioning strategy, assessing when, how, and how much it will cost them to actually execute it.

We also lead and manage network decommissioning programs from start to finish, often with a focus on driving strong execution and lowering the overall cost of such programs. Operators generally don‘t have full-time staff expert at managing extremely complex programs to tear down their networks.

Another thing we do is establish the logistics networks to collect decommissioned equipment, something called “reverse logistics supply chain”. Here we help the operator plan its asset disposition strategy: what they sell in the market versus what they move towards scrap, all with a mind to yield the largest residual value for their legacy infrastructure.

We also work with our tax practice to optimize the tax benefits that operators realize when they are undertaking decommissioning efforts. Since most of this legacy equipment is being upgraded and replaced with a new generation of equipment, there are often tax savings opportunities at the state level when it comes to exchanging equipment.

Similarly, we have folks in our practice who specialize in helping companies with their green policy — so here we make sure assets are being disposed of properly in terms of information security and that electronic waste is being disposed off responsibly and not being dumped in a lake or a field somewhere.

So, that’s a quick end-to-end view of the things that PwC is doing in decommissioning.

| What are the major pain points for operators in network decom? |

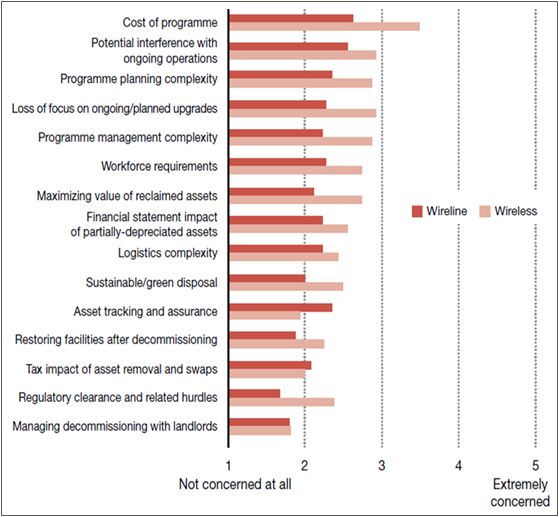

PwC conducted a research study in 2012 that highlights many of the top concerns of operators in this area (see Figure below). The biggest concern operators often have is around costs — and that makes sense because unlike most other programs a network operators run, network decom is not about generating new revenue, so there’s a lot of pressure to minimize exposure.

Decommissioning Concerns

of Wireline & Wireless Operators

From Study: Clearing the way: 2012 Outlook for telecom

network decommissioning

Preventing Decom from Impacting Customers

The second most-mentioned concern is that decom programs may interfere with ongoing operations. Telecoms don‘t want this one-time major activity to reduce their ability to serve customers.

Whenever you turn off a network to decommission it, there’s a long tail of customers affected. Enterprises are the toughest to transition because they have large volumes of users and mission critical applications that are running on a legacy network. And transitioning an enterprise is not as simple as flipping a switch. It often requires complex verifications and testing that can stretch over many months.

For example, in the case of one of our clients with a legacy network, the last customer who will be shut off on that legacy network is going to be a set of nuclear power plants. As you can imagine those plants run mission critical communications over those networks and they don‘t make changes without an awful lot of testing.

In the mobile space, many campuses, malls, and companies with large buildings have deployed in-building systems to improve coverage and capacity. Those in-building systems serve specific audiences who are often under separate contracts with landlords and enterprise customers. Every one of those has to be renegotiated and hopefully upgraded separately so the operator doesn‘t lose the customer. This issue is a big deal for many of our clients.

Program Planning and Management

And the third most cited concern is around planning these programs. Decommissioning is a very complicated program that can involve thousands of landlords and dozens — if not hundreds — of subcontractors who are doing the physical work.

When you add to the complexities of doing the reverse logistics, and coordinating with potential buyers of the equipment who are purchasing the released assets on the other end, you begin to see how big and risky decommissioning programs really are.

Besides securing potentially significant tax benefits, operators also need to manage the resale value of the equipment, and considerable logistics cost incurred in decommissioning. When you combine all these things, many operators struggle to put together a comprehensive program on their own, especially since they don‘t specialize in it. The tax breaks alone are an opportunity that operators often miss.

| Dan, thanks for this very interesting briefing. As a final thought, I’m wondering what your research tells you about how decommissioning differs across mobile and wireline service providers? |

The data seems to suggest that wireline operators are slightly ahead of the wireless industry in planning for decommissioning. We found that about three quarters of wireline network operators have begun to plan for network decommissioning while only half of wireless operators have done the same.

Of course, the challenges are quite different across these markets. In mobile, the assets are widely distributed at cell sites and switches, but they are relatively easy to get at: they are in buildings or shelters, and at the worst, they are on top of towers.

Wireline operators, face even greater challenges because much of their legacy assets in outside plant are buried in the ground or strung on poles. That’s expensive and hard to get at.

So there are considerations on both sides as to what assets are worth recovering versus those that you probably should abandon. In many cases, that decision revolves largely around logistics costs: how much will it cost to deconstruct or even dig stuff up and ship it somewhere versus the amount of money that may be recoverable and the risks and liabilities that are incurred in abandoning infrastructure.

NOTE TO READERS

PwC has prepared a fine research paper for download entitled: Clearing the way: 2012 Outlook for telecom network decommissioning. The paper reports the results of a study PwC conducted in 2012 and highlights the drivers, plans, readiness, and key concerns associated with network decommissioning.

Copyright 2013 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum