| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

August 2019

ARM Data Center Software’s Cloud-Based Network Inventory Links Network, Operations, Billing, Sales & CRM to One Database

The story of telecom network inventory is the decades-long, multi-billion-dollar quest to fix massive accuracy problems by patching together siloed systems with duct tape and chicken wire.

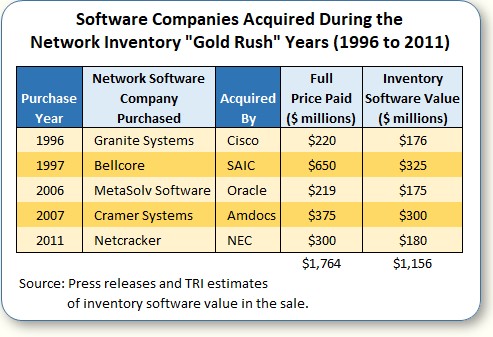

I’m not sure anyone has documented the actual money major telcos spent in the last 25 years to fix their inventory problems. But we can get a good idea by looking at the money network integrators spent on inventory software.

In the 1990s, Bellcore and several entrepreneurial vendors were busy selling network inventory software platforms for telcos. Soon enough, major equipment vendors and integrators became eager to acquire an inventory software company to gain an edge in winning lucrative transformation projects at Tier 1 and 2 telcos.

What followed was a Gold Rush to acquire these software firms. Altogether an astounding $1.2 billion was paid for inventory software, as shown in the chart below.

So what was the end result of these massive software vendor investments?

Well, the network integrators and tech giants got their money back, and quite a bit more. In many cases, the actual inventory software was given away free to pave the way for systems integration projects costing telcos tens of millions of dollars to implement and maintain.

But as for the telcos themselves? Well, things didn’t go as well. In fact, lots of network inventory conversion and transformation projects failed completely.

Meanwhile, the telecom world has moved on and most large incumbent telecoms are still “encumbered” by legacy network inventory systems that were never designed to compete effectively in telecom’s new world:

- The Wild Success of On-Line Video, Mobility, and Cloud creates sharp demand for fiber infrastructure, data centers, and metro densification, so operators are forced to keep up with dynamic network changes and greater connection complexity.

- Past Inventory Programs Soured Telecoms on the risks and expense of buying software the old way. However operators of all sizes are now seriously looking at new cloud solutions and business models that lower the costs, provide built-in security, and don’t require marrying a vendor for life.

- A Siloed Network Inventory System is No Longer Adequate — Today’s telecom market is a fast-moving one with hundreds of potential connection partners. So without an integrated system and workflow that ties together network, finance, operations, and sales information, a carrier simply can’t keep up with the accuracy and speed required, given the larger volume of network changes required.

Clearly, the answer to the telecom’s decades-long network inventory problems is a better system design and fresh thinking.

And on that point, I’m pleased to introduce Frank and Joe McDermott, two brothers who are CEO and COO respectively of a new cloud software company called ARM Data Center Software, a firm focused exclusively on solving network inventory problems for operators large and small.

In the interview, the McDermotts provide great depth on this issue. Beginning with Frank’s account of inventory issues faced as manager of a large carrier’s transport shop, they diagnose the major workflow, complexity, and integration issues that informed the development of ARM’s new network inventory system, cARMa.

From there, they explain how even a small operator or data center can actually use cARMa to clean up its inventory and get the company working on a back-office unified system running on a single database. They also explain the bountiful benefits gained by developing cARMa within the Microsoft Dynamics cloud architecture.

Finally, for those revenue assurance experts who have long worried about the high cost of stranded network assets, the McDermotts explain how a single-database inventory system neatly solves that issue.

| Dan Baker, Editor, Black Swan Telecom Journal: Frank, the features and design principles behind your cARMa network inventory solution were well-informed by your experience as a key transport network manager at a large carrier. Can you share with us some of the key problems you faced? |

Frank McDermott: Sure Dan, this was 2007, a time when Level 3 was trying to stitch together the inventory of the carriers it had acquired: Broadwing, Genuity, Progress Telecom, WilTel, Looking Glass, and Telcove. I ended up running the transport design shop for those business units and I had on staff 52 direct reports, including the off-net team. So you can bet I lived and breathed the huge operational and financial challenges of integrating multiple networks at once.

Install intervals and ultimately revenue recognition all depend on network inventory accuracy. On average, based on work with multiple operators, ARM believes 21% of network inventory is inaccurate in the telecom industry, so it’s easy to see when you try to merge or interconnect one network to another, the ugly errors get exposed.

And in the transport network, we really see the trouble when CFAs (Carrier Facility Assignments) are issued to connect to someone else’s port and the Letters Of Authorization (LOAs) that specify a cross-connect to an authorized port on a particular panel and you discover the jumpers are occupied with another cable you didn’t expect to be there.

So when that happens, the order fails and the whole connection process has to start over. And that failure occurs at the worst time, because the customer is expecting to use the new ports within days, and now you’re looking at a month of lost revenue and unhappy customers.

The genesis of ARM was when I left Level 3, I had gained a reputation as the guy who could fix “Busy CFA” and started consulting in the industry. At the time my brother Joe was working in Silicon Valley and he understood the scale of the problem and the potential for software and good process to address it. We founded ARM with the vision to fix other people’s networks, setting target on reducing that 21% defect rate in inventory data and using intelligent software to help people clean up.

So cARMa became the glue that held our entire operation together. Soon enough, the customers we helped came back to us with the obvious question, “Well, how do I keep my inventory clean?” So we decided to make cARMa software available to them, expanding from the internal tool ARM used to do cleanups, into a SaaS network inventory system.

We were smart about it and we went to Microsoft to build our unique integrated inventory software out in their full featured secure cloud. I honestly believe we now have the most capable network inventory system purpose built for telecom out there.

| When you add it all up, what is it about legacy inventory systems that don’t allow you to accurately keep track? |

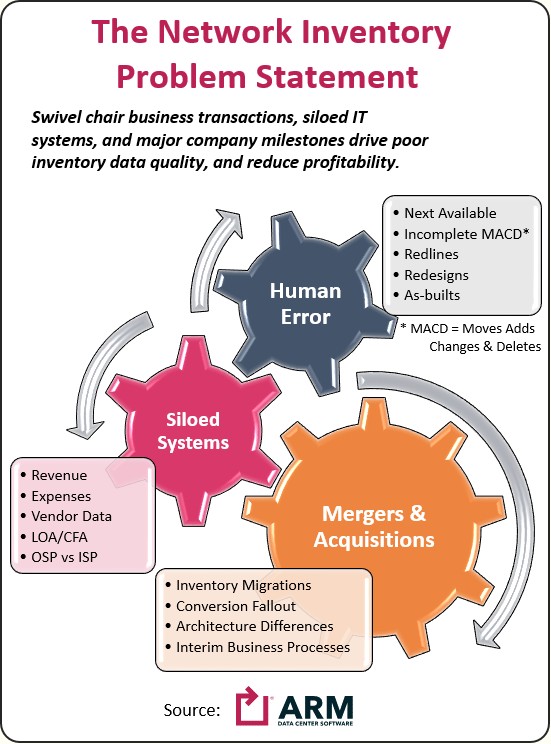

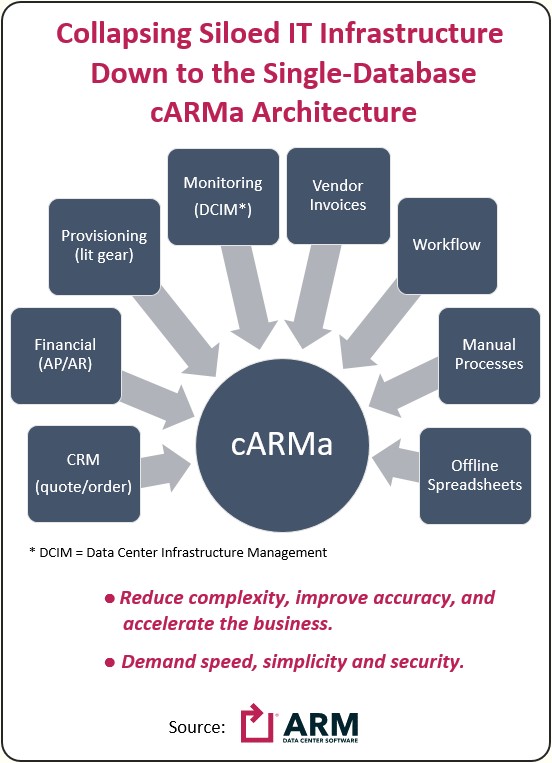

Joe McDermott: The fundamental problem is that inventory systems were built in isolated buckets: a billing system, a CRM system, an inventory system, and a provisioning/ordering system, but none of them were designed to share information or talk to each other natively.

That legacy approach was sufficient decades ago because the volume of network changes was small enough that data integrity was maintained as long as people conscientiously checked between systems to ensure that every step of the process was completed.

But today, the number of changes, connections, and network partners has grown immensely. And that demands digital transformation — a single system that fully integrates all aspects of the inventory data into a single source of truth.

For example, if you get a disconnect order, that goes to finance to turn off the billing. Then another request is sent to disconnect orders for all your cross connects and leased access. But in legacy systems you could never go to just one spot to determine if all these things happened. It was never easy to get an answer to the vital question: Are all of those expenses attached to the original order actually turned off?

This is why we designed cARMA from day one to be a kind of Rosetta stone of the entire network or data center operation.

I want to know: what am I making and paying to deliver service — all of the revenue and every expense. Then I want to take all that financial side data and build it on top of the network so I know the full context of everything that’s done in the network. And the upshot is: I can now make good decisions very easily and quickly.

| How does your cARMa network inventory system fix the problems inherent in theses traditional inventory systems? |

Frank McDermott: cARMA really begins by recognizing you can easily connect to your legacy system and pull all that information into a single pane of glass. There’s only one database in cARMA, but includes multiple data sources — inventory, CRM, finance, billing and operations — with robust workflows tying everything together.

With cARMA you can see the full picture that correlates all available information. You see the order from the customer. And when the customer cancels service, you can see the incoming disconnect email and all the expenses attached to the original order. And the customer disconnect order initiates work orders to the field techs to disconnect all the connections no longer needed.

Then as each field tech reports task completion, billing is informed that the expenses from Equinix, DRT, or other provider show the status has moved from an active to inactive expense. And the next step is to check that it is no longer on the bill you receive.

So there you have it — a closed loop process that combines your finance, your operations, and your customer relationship where tasks are checked off in the proper order.

And you performed all these tasks efficiently because you didn’t have to look at 50 different systems to make sure it executed properly. In the end, the job is easier, more streamlined, and more profitable because you have greatly reduced the expense of maintaining an up-to-date inventory.

| The other major problem, of course, is all the passive physical facilities in the plant you cannot verify through software. |

Joe McDermott: Yes, it’s a big issue because you do have dumb network elements like patch panels and fiber jumpers — with no way to add remote monitoring to those things.

The best we can do is build workflow processes around those that say, “Ok, this jumper was supposed to be removed, so let’s create workflow that assigns a tech go out and confirms that it was done.” Now here is the cool part with cARMa — the tech actually takes a picture of either the installed jumper with the new label or the removed jumper. After we see that picture, we can close out the case.

So that picture is worth a thousand words: it not only confirms the quality of the inventory, but also the quality of the install and proper cable management. Are the cables a mass of tangled spaghetti that’s blocking the air flow and overheating components? Well, you now have a record of that.

Storage is cheap these days, so those images of labels or installs will be around forever. Fifteen years from now you will be able to click to that jumper on those ports and see the original install picture and if it is the same, then you know exactly what it is and what that was installed for.

This solves another key problem today: people have insufficient knowledge on the history of an installation. So a stranded asset can sit there and be an expense on the books for 10, 12, or 15 years. We found one case where an operator spent $200,000 on a power feed that was never connected at all.

| One of the biggest headaches comes before the new inventory system is fully up and running: the problems of conversion. |

Frank McDermott: Believe me. Thanks to the nightmares I faced at Level 3, we put great effort into enabling cARMa to perform intuitive and painless conversions. And many of our users say they appreciate this feature the most.

It begins with our ability to reach out to immediately acquire data, connecting to the legacy system where we support just about any database technology. It’s a matter of configuration: no code required. On top of that, you can update the configuration when you need to. So by drawing data directly from the live legacy systems, we eliminate the double entry and swivel chair errors.

The first benefit the customer gains is an almost instant view of how their data would perform within cARMA — and they have full control over when active uploading begins. They can stay in the proactive-monitoring-of-the-legacy mode as long as they want. Remember, there’s no financial commitment with cARMa.

The operator is not rushed to convert. You can set up our data imports and schedule them, say every 15 minutes, every hour, or every day, and wait for the perfect time to make the cutover to cARMa.

| How does a company start using cARMa? It lives in a cloud application, so is it purchased like a cloud system? |

Joe McDermott: Well, cARMA will be available in the Microsoft AppSource store where people can get cARMa on a 30-day trial basis — just like ordering an Office 365 trial.

But even in that short 30-day period, the customer will be able to stand up their system and achieve some real results.

For instance, we’ve developed scripting and integration that reconciles the many invoices they get from, say, a major carrier or data center like Equinix.

So you can upload these bills into cARMA and find everything on the bill that doesn’t exist physically in your network. And you can also make sure you are not paying for unnecessary cross connects. Often when a customer disconnects, the $10,000 circuit is shut off, but the $300 a month cross-connect fee is forgotten about.

We pull all of that intelligence together to ensure all the cross connects have a home and that disconnects happen in the right sequence. Then we back all that up with our workflow so we have the history of the LOAs. That way, if Equinix comes back and says a port is busy, we can tell them: “You had this order to install it, and this order to disconnect it, so your guys didn’t do their job.”

So that’s just an example of how a new client can exploit its 30-day cARMa trial. In that time, they’ll have a very good idea if the system is right for them. Then, it’s a month-to-month purchase from that point on.

| Now you’ve built cARMa on top of the Microsoft Dynamics cloud platform. What did that decision buy you? |

Joe McDermott: It buys us a great deal, Dan. It totally differentiates cARMa in the marketplace.

By going with Microsoft, we get — out of the box — exceptional connectivity, security, and mobility. By contrast, if your starting point is a legacy MetaSolv, Granite, or whoever, then you’re opting to build connectivity, scalability, and security on top of that legacy, and that’s an incredibly slow and expensive way to go, especially when you want to connect to a new enterprise IT application. In cARMa, we have hundreds of connectors already built by Microsoft that we can use to integrate data from nearly any existing system in a matter of minutes.

To be honest, a key concern of ours was security. We wanted to be sure that from day one we could pass anybody’s security audit. And you just know that people are little more trusting of Microsoft managing their data security as opposed to Frank and Joe down the street.

So we said, let’s piggyback on all the incredible work Microsoft has done and then build our system on top of that. That is why we have great things that live natively within cARMA. The legacy systems rarely have that capability, and where they do, it costs the end customer a ton more money to have it.

So we can boast: “The CRM built into cARMA is better than Salesforce.” And that’s true because Microsoft has invested enormous time and money to make Dynamics CRM the winner. Even better, we’ve included Dynamics CRM natively in cARMa at no additional cost to the end user. But if an operator wants to keep using their Salesforce licenses, we can pull their Salesforce data into cARMa too with standard connections that Microsoft has already built.

Going with Microsoft allows us to focus on building the best network inventory platform possible. For example, one of the biggest issues is building mapping into the cARMa application — showing a map of the US and all the cities roads. Well, Microsoft’s cloud platform makes it easy to graphically portray all the outside plant, inside plant, and logical connections.

| What about network troubleshooting and analytics? |

Joe McDermott: We get great topology views through a cARMa tool we named Guru that fill in the gaps to see all the intermediate points, not just the endpoints. And as you know, getting the full picture like that has been the dream of every NOC.

The user can see the impacts of a fiber cut or a component going down. Not only do you see customers that originate or terminate at this trouble point, you can see every circuit and every customer that passes though that trouble point. There’s tremendous value when you see the hierarchy up and down like that.

Leveraging Microsoft’s analytics, we are able to look at the different layers of the network. We facilitated that through custom code that drives extensive reporting and slicing of the data which we could never do before. You can’t justify rebuilding that capability from scratch. It would cost way too much, but working with Microsoft, it comes with the package.

| Frank and Joe, thanks for this insightful briefing. The fact that cARMa was designed from scratch to correct decades-old inventory problems — and is built on a modern cloud platform and business model besides. Well, it's something telcos have dreamed of having for a long time. |

Frank McDermott: Dan, I can’t emphasize enough: this inventory system operates on a single database, and guarantees you one version of the truth.

Even though applications in cARMA present the information differently, each department is still responsible for updating their portions of the data. And organizations can continue using their systems of choice. Finance maintains the billing and general ledger. The network folks set the port assignments and provisioning. cARMa is pulling all that real-time data into one view, so everyone is updating the same integrated database underneath

This is a big change from inventory stovepipes that requires duplicate entries in separate data stores, which leads to costly errors and disputes over whose data is correct.

Getting all the departments looking at one database is probably the single most revolutionary thing cARMa delivers. And we owe that capability to wrapping cARMa’s solid network inventory processes and workflow around Microsoft Dynamics’ many cross-industry business applications and powerful tools.

At ARM Data Center Software, we’re fully committed to bringing the capability operators would pay tens of millions of dollars for, and offering it as a SaaS software product with a highly affordable, pay-as-you-go cloud business model.

Copyright 2019 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum