| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

May 2013

Science of Analytics: Bringing Prepaid Top Ups & Revenue Maximization under the Microscope

Having a mobile postpaid billing arrangement is a lot like marrying your service provider.

It’s usually a win/win for both parties as the operator and customer agree to give up some excitement and emotional roller coaster rides for a stable, predictable relationship.

By contrast, however, prepaid mobile puts the operator in a bit of an uncomfortable spot -- kind of like blind dating every night with people who don‘t have Facebook pages. Will the customer be loyal and spend her money freely? And what do you say to customers you don’t know very well? Will your earnest pleas for monetary love work, or will the relationship end suddenly with a teary-eyed farewell?

Well, making a prepaid operator’s relationship with casual customers much less awkward and more financially rewarding is what Globys is all about. The company has developed a powerful contextual marketing solution specifically for a worldwide prepaid market where Globys has established a great presence in places like Latin America and Asia.

And here to explain its business model is the company’s CEO, Derek Edwards, a big champion of scientific marketing. My discussion with him provides a very interesting snapshot of the challenges prepaid operators face in maximizing their revenues.

| Dan Baker: Derek, tackling the prepaid market is a tough assignment but I imagine the international globetrotting is a lot of fun at the same time. |

Derek Edwards: Yes, Dan. Mobile prepaid is a very interesting market indeed. In fact, I would say, prepaid subscribers are the customers that carriers know the least about.

The operator is not interacting with prepaid customers on a monthly basis. You’re not sending a bill, nor do you have detailed profiles on these customers, especially in the developing world where customers are buying SIMs very inexpensively at a grocery store.

But nonetheless, prepaid customers are constantly making revenue impacting decisions by the way they use their phones -- when they top-up, where they top-up, and how much of a balance they keep.

And in the prepaid world, churn is a major problem. Some carriers have churn rates higher than 80% among their base. It’s not like the U.S. market where you are worried about the hassle of porting your phone number. In many markets, people don‘t care about keeping their phone number. They are more interested in saving money.

So what we do is take the carrier’s data and then figure out exactly what the carrier should market to each individual customer at any given point in time based on where that actual customer is from a behavioral standpoint -- did they just top up, is their balance low, are they a new data user?

And by taking that information and sending simple offers -- typically via an SMS message -- you actually drive some pretty significant results.

| Increasing the ROI on a carrier’s marketing campaigns is an important result of analyzing customer behaviors. How do you accomplish that at Globys? |

Yes, delivering effective -- and measurable -- campaigns is key to our success and this requires the right technologies and the right skill sets. We have a large team of analytics folks, including PhD data scientists with disciplines ranging from computer-automated pathology diagnosis to pharmaceutical drug discovery to high frequency financial trading. And just as important, we have a team that specializes in mobile carrier marketing — people who have run the loyalty and promotion programs for some of the world’s largest carriers. This team possesses a unique expertise in quantitative marketing and helps our carrier clients connect the dots between the science and the marketing.

Top-Up Campaigns and the Mid-Cycle Sweet Spot

The whole concept of our campaign approach is to trial a lot of different offers, then see what works, and then rapidly scale. This strategy is a 180 degree turn from the traditional process of running six-month trials where you dream up the campaign, gain approvals, roll it out, run it for a couple of months, and then wait a couple of more months to get the data to see if it worked. We shorten that cycle into days or weeks and gather enough statistical evidence to justify rolling a campaign out to a wider audience.

For example, one campaign strategy we utilize is to deliver offers as customers enter the ‘mid cycle’ context. If the objective is to shorten the customer’s recharge cycle, we engage the customer half-way to the point when they are predicted to top-up.

The offer itself could be something relatively simple, like free minutes. Often, we take offers that the carrier already has in its portfolio and figure out how and when to use them more effectively.

Now “mid-cycle” sounds like a very easy thing to define, but in fact, it is a very subtle thing. It’s highly individualized to how the customer uses that service. In fact, the mid-cycle might be very soon after they’ve recharged. It really depends on how the customer consumes his balance. Some customers actually run out of balance very early in their cycle, so they tend to recharge often. Others preserve their balance when it is high and then spend it all in one burst at the end of their cycle. So writing algorithms to calculate the mid-cycle for individuals is a very complex thing.

We have found that it’s way more impactful to hit the customer at their mid-cycle point than, say, triggering an offer when the balance of the customer goes from $20 down to $10. The point is to reach the customer when they actually think they are halfway through their timeframe.

| So tell us more about your main product, Mobile Occasions. You call it a contextual marketing solution, but what does that actually mean? |

Dan, contextual marketing is really about applying a scientific approach to marketing. Now I’m not just throwing out the word “science”. At Globys we actually assembled a diverse team of scientists and had them apply their principles to telecom data.

For instance, on our team we have experts in location, crowd sourcing, quantum computing, tweeting, computer vision, and computational chemistry. A few months back our molecular biology expert was telling me about the parallels he’s found between telecom analytics and predicting how molecules interact. I was surprised too at the similarities.

So let me walk you through our methodology here:

Contextual Marketing

When I say a contextual marketing solution, I mean taking all of the carrier’s data, turning it into actionable behavioral analysis and applying real-time decisioning to deliver the right marketing treatment to each customer at the right time. And our approach to marketing is very personalized — down to the individual customer level.

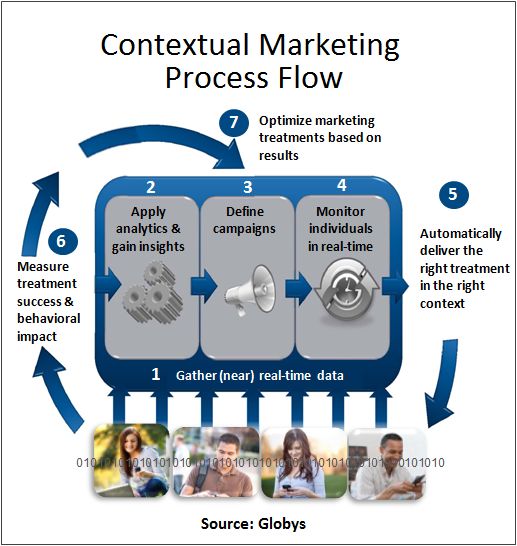

The overall process we employ with our contextual marketing is shown in the diagram below and I’ll explain it in more detail as we go along.

1: Data Exploration and Analysis

The first capability of our solution is data exploration and analysis. We take financial transactions such as purchases, spending, balances, etc. and then combine that with call data records across voice, SMS, data, even video, and we truly get our hands on that data in as close to real-time as we can.

From that we create a “longitudinal” view of every customer. Now in the telecom industry we are actually quite fortunate because in the online world, marketers face huge volumes of data, but they really struggle to connect one event with another and determine who the web surfer actually is.

In telecom, however, we not only touch huge volumes of data, but that volume is far more concentrated on a per customer basis. And it’s that richness of customer-specific data that allows us to combine all of the different data sources we have about the customer into a single longitudinal view.

For example, we can determine that a customer purchased an international calling voucher, made the next five calls to Indonesia, and did a full recharge. We can also detect subtleties — she sent a high quantity of SMSs to a very small social graph of individuals, which resulted in her receiving very few return text messages and several return voice calls.

So, each of these views is like plotting events on a timeline for a particular customer. And that representation then allows for interesting sequential pattern analysis and pattern recognition, which allows us to model what we believe each customer will do next.

So it’s at that point that we identify cohorts, or groups of users that have these common patterns of behavior. Our advanced marketing team then leverages those data insights to determine the best ways to act on those events and begins formulating a variety of treatment inputs.

2: Multi-Factor Experimental Designs

And that leads us to the second capability of our platform which is the ability to execute multi-factor experiment-like designs.

We don‘t just formulate messages, target individuals and then hammer them with messages to see which ones work. Instead we model the different messages, timing, and other parameters in a more selective manner. That way, you can ping the fewest number of customers possible — enough to get a significant statistical sampling — and still be able to understand and refine what’s working and what’s not.

Then we take the ‘what’s working’ and scale these treatments to the customer base while keeping the experimental designs ongoing so we can continue to test and tweak a large variety of multi-faceted offers.

When we first go into a carrier client, we find they often have some very successful pieces in their offer mix, but invariably they are also pitching offers that are dragging down their results.

Carriers tend to be very surprised to learn that some of the messages they send actually have a negative effect on revenue generation and may ultimately be driving customers away.

Again, the goal around experimental design is to eliminate that risk by determining — in a scientific manner — what works best and for whom, whether that requires ten different offers or hundreds.

3: Advanced Machine Learning

The third and final capability of our contextual marketing solution is advanced machine learning that automatically drives ongoing campaign optimization.

Because we have this longitudinal representation of each customer, we can apply machine learning techniques to continually discover patterns in the customer groups that exhibit similar behavior and determine the best way to influence desired behaviors. This allows carriers to move beyond the traditional event-triggered approach to an approach where the right offer is delivered in the right context -- based on an ever-changing understanding of an individual customer’s behavioral profile and associated needs.

These advanced techniques also enable us to detect and act on the correlation among multiple subscribers. By uncovering social graphs and then using the 80:20 rule, we can actually target a small number of individuals to influence their much wider social group.

Revenue Lift -- Recharge Stimulation

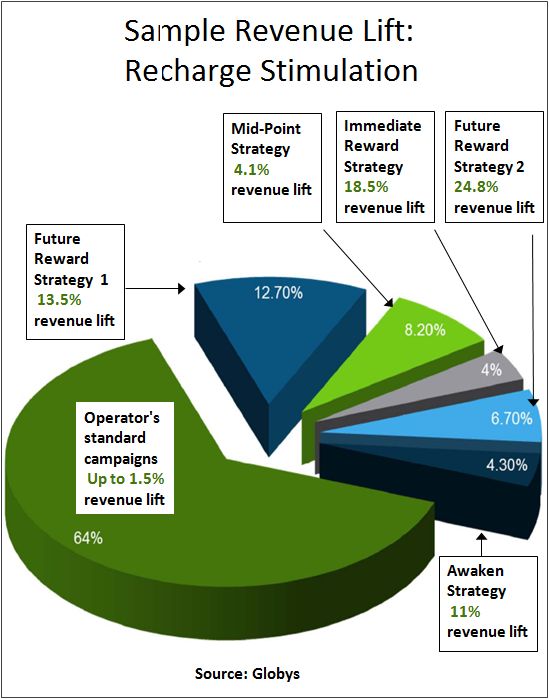

So how do we apply this contextual marketing approach to the operator’s customer base? Let’s refer to the chart below which represents the revenue lift associated with recharge stimulation marketing activity.

The entire customer base is represented by the pie which totals 100%. And the chart shows the various campaigns being applied. For example, the Future Reward Strategy 1campaign that we devised is applied to 12.7% of the customer base. And when we target that group -- with personalized, one-to-one treatments aligned to this specific campaign strategy -- we achieve a 13.5% revenue lift, which is considerably better than the 1.5% or less revenue lift achieved by the operator’s standard campaigns.

Over time, the goal is to identify offers that work across the entire base of customers, but during initial implementation, it’s helpful to demonstrate the transformational power of our contextual marketing approach by using control groups. This enables us to measure our progress and show -- by the numbers -- how the results of our approach stack up to the carrier’s ‘business as usual’ marketing activity.

| What is the Awaken Strategy all about? |

Well, with prepaid customers, it’s common that inbound calling or messaging to a device is free and so it can be quite prevalent that customers purchase a very low cost SIM and once they activate their phone, they may never recharge.

So, the Awaken Strategy is actually designed to generate the customer’s first recharge and then stimulate their first outbound usage and activity with the objective of generating some revenue for the carrier.

The interesting thing about this strategy is that once you get someone to move from zero balance to carrying even a small balance, they tend to not churn as quickly because they have some unused value in their account.

| Does your approach employ demographic data? |

Surprisingly, no. A lot of companies focus on identifying, say the 20-year old female demographic. But we don‘t care about the 20-year-old female per se. Our segmentation is based on customer behavior alone, so it may turn out that the 20-year-old female and the 70-year old grandmother both text their families all the time and share a similar profile. And you would treat them from a marketing promotions perspective very similarly as opposed to assuming that the grandmother is maybe a low tech user because that fits the average senior user profile.

That’s the core of our analytics philosophy: it’s behavior that matters. You can learn an awful lot by just looking at a customer’s inbound and outbound data usage for example.

| Let’s talk a bit about Globys. You’ve explained your analytic approach. So how do you go to market? What differentiates Globys there? |

Well one thing that’s been very successful for us is offering customers a pay for performance model. The majority of our clients work with us on a complete revenue share model. It’s all about increasing their revenue lift, growing their active base, and/or reducing churn. You succeed and we succeed.

For years, carriers have been hearing the great stories about the benefits of large data warehouses. But very little of that data has actually made it down to the marketing departments at carriers in a way that is actionable. So we’re capitalizing on the fact that carriers are skeptical about making large upfront investments in analytics platforms — proving to them the value of our solutions to then foster long-term, strategic partnerships.

| We all know that prepaid is a big hit in countries like Brazil, Italy, India and Southeast Asia, but Apple’s iPhone kind of moved the needle towards wider postpaid adoption in developed countries especially. Do you see that trend changing? |

We are beginning to see some very interesting things -- and the postpaid versus prepaid market debate varies greatly depending on where you are in the world. Mobile consumer demands are extremely diverse as you move from country to country or even region to region and one thing that we’ve learned is the importance of understanding the cultural nuisances which impact the perception of value among customers. Trends such as prepaid smartphones and soft-SIM cards are very appealing for some consumers -- especially as the complexity and cost around data services continues to mount. Although postpaid may come with a lower priced phone, consumers are realizing the value -- and freedom of choice — in not being tied to a carrier for an extended time.

Look at T-Mobile’s hybrid plan which is essentially 4G unlimited. We can now have unlimited voice and data with prepaid and just go month to month. Now the value is controlled based upon throttling the 4G limit -- how much data the user gets to transfer at 4G speeds. You can bet that type of plan is cannibalizing to T-Mobile’s postpaid base but I think we are going to see more of these prepaid hybrid plans as carriers search for ways to expand their market share in unconventional ways.

While my evidence is anecdotal, among my circle of friends and family there’s a large base who are using prepaid with iPhones and such. It is quite surprising for me and it is amazing how much they are saving.

| Wow, if the market moves your way, your focus on prepaid could put you in a great position. Good luck on that front. And thanks for a very nice briefing. |

Copyright 2013 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

cSwans of a Feather

- Non-Verbal Speech Analytics: Monitoring Voice Calls in Real-Time for Customer Care, Sales, Retention & Onboarding — interview with Yoav Degani — Non-verbal speech analysis studies the emotional context of voice qualities like intonation, tone, emphasis and rhythm. A pioneer in voice analytics explains how its technology benefits customer care, sales, retention and onboarding.

- Will Real-Time Decisioning Save Big Data Analytics from Overblown Hype? — interview with Tom Erskine — Telecom analytics is more than just collecting and analyzing data. It’s also about taking action — correct action — often in real-time and across a complex provisioning environment. In this interview you’ll hear how next best actions are creating value in retention and upselling through a more flexible, business-process driven approach.

- The Customer Engagement Era: How Personalization & Backend Integration Leads to a Richer Mobile Biz — interview with Rita Tochner — How does a mobile operator move its subscribers to higher levels of spending and profit? Fierce competition, social media scrutiny, and the high cost of new networks all conspire against these goals. In this interview, however, you’ll learn how engaging better with customers, getting more personal, and being more sensitive to their individual needs is the path forward.

- B/OSS Mathematics: The Quest to Analyze Business Problems & Drive Operating Decisions — interview with Matti Aksela — Analytics is the glory of mathematics brought to practical use. And in telecom, analytics has merely stratched the surface of its full potential. In this article, you’ll learn how machine learning is being combined with the power of CDR number crunching to optimize mobile top-ups, control churn — and in the future, help telecoms make critical network and operating decisions.

- A Mobile Marketer Service: Bridging Personalization & B/OSS Flowthrough — interview with Efrat Nakibly — Marketing analytics is a prescriptive program for driving actions such as sending a timely promotion to a mobile subscriber. But completeness demands that you also be able to provision that treatment, qualify the promotion, and keep billing fully in the loop. This article shows how a managed services program can deliver such an end-to-end process and manage customer life cycles on a one-to-one basis.

- Science of Analytics: Bringing Prepaid Top Ups & Revenue Maximization under the Microscope — interview with Derek Edwards — Prepaid subscribers are the customers that carriers know the least about. The operator is not interacting with prepaid customers on a monthly basis. You’re not sending a bill, nor do you have detailed profiles on these customers, especially in the developing world where customers are buying SIMs at a grocery store. This interview explains how contextual marketing meets the unique analytics challenge of prepaid customers.

- Profitable 3G: China’s Mobile Operators Monetize Networks with Retailers & Partners — interview with Kevin Xu — Mobile operators are at the center of explosive growth in wireless services. But to exploit this opportunity requires IT ingenuity and a broader view on how the mobile user can be served. In this article you’ll learn the innovative techniques Chinese operators use to monetize 3G networks via analytics and partnerships with retailers, social networks, and advertisers.

- Customer Analytics: Making the Strategic Leap From Hindsight to Foresight — interview with Frank Bernhard — Are your company’s analytics programs scattered? Is there a strategy in place for customer analytics? This interview with a leading telecom analytics consultant explains why strategy and planning around the analytics function is crucial to getting your money’s worth. Topics discussed include: hindsight vs. foresight; an advanced analytics program; and the interface sophistication required to support high end vs. low end analytics users.

- Analytics Meditations: The Power of Low-Cost Hardware and the Social Network Within — interview with Ken King — Analytics didn‘t arrive yesterday. Data warehousing and BI have been in the telecom vocabulary for twenty-five or more years. In this interview, you’ll gain a perspective on why “big data” changes the game and why social network (or social circles) analysis promises the next level of insights. Other interesting topics include: segmenting the analytics market, engaging with carrier clients, and upgrading from older- to newer-style methodologies.

- Shared Data Plans: The Challenge of Managing a Family of Pricing, Revenue Assurance, Fraud, and Network Policy Issues — by Amit Daniel — Verizon Wireless‘ recent announcement of its move to shared data plans for families shook the mobile industry. In this column, cVidya’s Amit Daniel shines a spotlight on the knowhow and analytics tools that operators now deperately need to offer the right shared data price plans, ensure bandwidth throttling is handled correctly, and address new fraud concerns.

- Social Networking for Telecoms: How To Enlist Friends and Family as Mobile Marketers — interview with Simon Rees — Social Network Analysis (SNA) is about exploiting data on “friends and family” connections to combat churn and win new CSP business. The article explores how an analysis of the ebb and flow of CDRs, phone calls, and messages, can identify key influencers and drive powerful marketing campaigns.

Related Articles

- Tokopedia, Indonesia’s E-Commerce King, Partners with 11 Million Merchants; Adopts Multi-Cloud to Drive Innovation — interview with Warren Aw & Ryan de Melo — Indonesia’s Tokopedia, founded in 2009, has grown to become one of world’s leading e-commerce players. Read about its success, technology direction, and multi-cloud connectivity adoption.

- Bridge Alliance: Knocking Down Regional & Mobile Connectivity Barriers so Connected Car Markets Get Rolling in Asia — interview with Kwee Kchwee — The CEO of an Asian consortium of mobile operators explains how they help simplify and harmonize their members‘ operations in support of multi-national corporations. This integration is enabling two huge industries to come together in Asia: auto manufacturing and telco.

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw — Network as a Service, powered by Software Defined Networks, are a faster, more agile, and more partner-friendly way of making data global connections. A leading NaaS provider explains the benefits for cloud apps, enterprise IT, and IoT.

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price — A leading wholesale executive explains the business challenges of the current global IoT scene as it spans many spheres: technical, political, marketing, and enterprise customer value creation.

- Senet’s Cloud & Shared Gateways Drive LoRaWAN IoT Adoption for Enterprise Businesses, Smart Cities & Telecoms — interview with Bruce Chatterley — An IoT netowork pioneer explains how LoRaWAN tech fits in the larger IoT ecosystem. He gives use case examples, describes deployment restraints/costs, and shows how partnering, gateway sharing, and flexible deployment options are stimulating growth.

- ARM Data Center Software’s Cloud-Based Network Inventory Links Network, Operations, Billing, Sales & CRM to One Database — interview with Joe McDermott & Frank McDermott — A firm offering a cloud-based network inventory system explains the virtues of: a single underlying database, flexible conversions, task-checking workflow, new software business models, views that identify stranded assets, and connecting to Microsoft’s cloud platform.

- Pure Play NFV: Lessons Learned from Masergy’s Virtual Deployment for a Global Enterprise — interview with Prayson Pate — NFV is just getting off the ground, but one cloud provider to enterprises making a stir in virtual technology waters is Masergy. Here are lessons learned from Masergy’s recent global deployment using a NFV pure play software approach.

- The Digital Enabler: A Charging, Self-Care & Marketing Platform at the Core of the Mobile Business — interview with Jennifer Kyriakakis — The digital enabler is a central platform that ties together charging, self-care, and marketing. The article explains why leading operators consider digital enablers pivotal to their digital strategies.

- Delivering Service Assurance Excellence at a Reduced Operating Cost — interview with Gregg Hara — The great diversity and complexity of today’s networks make service assurance a big challenge. But advances in off-the-shelf software now permit the configuring and visualizing of services across multiple technologies on a modest operating budget.

- Are Cloud-Based Call Centers the Next Hot Product for the SMB Market? — interview with Doron Dovrat — Quality customer service can improve a company’s corporate identity and drive business growth. But many SMBs are priced out of acquiring modern call center technology. This article explains the benefits of affordable and flexible cloud-based call centers.

- Flexing the OSS & Network to Support the Digital Ecosystem — interview with Ken Dilbeck — The need for telecoms to support a broader digital ecosystem requires an enormous change to OSS infrastructures and the way networks are being managed. This interview sheds light on these challenges.

- Crossing the Rubicon: Is it Time for Tier Ones to Move to a Real-Time Analytics BSS? — interview with Andy Tiller — Will tier one operators continue to maintain their quilt works of legacy and adjunct platforms — or will they radically transform their BSS architecture into a new system designed to address the new telecom era? An advocate for radical transformation discusses: real-time analytics, billing for enterprises, partnering mashups, and on-going transformation work at Telenor.

- Paradigm Shift in OSS Software: Network Topology Views via Enterprise-Search — interview with Benedict Enweani — Enterprise-search is a wildly successful technology on the web, yet its influence has not yet rippled to the IT main stream. But now a large Middle Eastern operator has deployed a major service assurance application using enterprise-search. The interview discusses this multi-dimensional topology solution and compares it to traditional network inventory.

- The Multi-Vendor MPLS: Enabling Tier 2 and 3 Telecoms to Offer World-Class Networks to SMBs — interview with Prabhu Ramachandran — MPLS is a networking technology that has caught fire in the last decade. Yet the complexity of MPLS has relegated to being mostly a large carrier solution. Now a developer of a multi-vendor MPLS solutions explains why the next wave of MPLS adoption will come from tier 2/3 carriers supporting SMB customers.

- Enabling Telecoms & Utilities to Adapt to the Winds of Business Change — interview with Kirill Rechter — Billing is in the midst of momentous change. Its value is no longer just around delivering multi-play services or sophisticated rating. In this article you’ll learn how a billing/CRM supplier has adapted to the times by offering deeper value around the larger business issues of its telecom and utility clients.

- Driving Customer Care Results & Cost Savings from Big Data Facts — interview with Brian Jurutka — Mobile broadband and today’s dizzying array of app and network technology present a big challenge to customer care. In fact, care agents have a hard time staying one step ahead of customers who call to report problems. But network analytics comes to the rescue with advanced mobile handset troubleshooting and an ability to put greater intelligence at the fingertips of highly trained reps.

- Hadoop and M2M Meet Device and Network Management Systems — interview with Eric Wegner — Telecom big-data in networks is more than customer experience managment: it’s also about M2M plus network and element management systems. This interview discusses the explosion in machine-to-machine devices, the virtues and drawbacks of Hadoop, and the network impact of shrink-wrapped search.

- The Data Center & Cloud Infrastructure Boom: Is Your Sales/Engineering Team Equipped to Win? — by Dan Baker — The build-out of enterprise clouds and data centers is a golden opportunity for systems integrators, carriers, and cloud providers. But the firms who win this business will have sales and engineering teams who can drive an effective and streamlined requirements-to-design-to-order process. This white paper points to a solution — a collaborative solution designs system — and explains 8 key capabilities of an ideal platform.

- Big Data: Is it Ready for Prime Time in Customer Experience Management? — interview with Thomas Sutter — Customer experience management is one of the most challenging of OSS domains and some suppliers are touting “big data” solutions as the silver bullet for CEM upgrades and consolidation. This interview challenges the readiness of big data soluions to tackle OSS issues and deliver the cost savings. The article also provides advice on managing technology risks, software vendor partnering, and the strategies of different OSS suppliers.

- Calculated Risk: The Race to Deliver the Next Generation of LTE Service Management — interview with Edoardo Rizzi — LTE and the emerging heterogeneous networks are likely to shake up the service management and customer experience management worlds. Learn about the many new network management challenges LTE presents, and how a small OSS software firm aims to beat the big established players to market with a bold new technology and strategy.

- Decom Dilemma: Why Tearing Down Networks is Often Harder than Deploying Them — interview with Dan Hays — For every new 4G LTE and IP-based infrastructure deployed, there typically a legacy network that’s been rendered obsolete and needs to be decommissioned. This article takes you through the many complexities of network decom, such as facilities planning, site lease terminations, green-safe equipment disposal, and tax relief programs.

- Migration Success or Migraine Headache: Why Upfront Planning is Key to Network Decom — interview with Ron Angner — Shutting down old networks and migrating customers to new ones is among the most challenging activities a network operators does today. This article provides advice on the many network issues surrounding migration and decommissioning. Topics discussed include inventory reconciliation, LEC/CLEC coordination, and protection of customers in the midst of projects that require great program management skills.

- Navigating the Telecom Solutions Wilderness: Advice from Some Veteran Mountaineers — interview with Al Brisard — Telecom solutions vendors struggle mightily to position their solutions and figure out what to offer next in a market where there’s considerable product and service crossover. In this article, a veteran order management specialist firm lays out its strategy for mixing deep-bench functional expertise with process consulting, analytics, and custom API development.

- Will Telecoms Sink Under the Weight of their Bloated and Out-of-Control Product Stacks? — interview with Simon Muderack — Telecoms pay daily for their lack of product integration as they constantly reinvent product wheels, lose customer intelligence, and waste time/money. This article makes the case of an enterprise product catalog. Drawing on central catalog cases at a few Tier 1 operators, the article explains the benefits: reducing billing and provisioning costs, promoting product reuse, and smoothing operations.

- Virtual Operator Life: Enabling Multi-Level Resellers Through an Active Product Catalog — interview with Rob Hill — The value of product distribution via virtual operators is immense. They enable a carrier to sell to markets it cannot profitably serve directly. Yet the need for greater reseller flexibility in the bundling and pricing of increasingly complex IP and cloud services is now a major channel barrier. This article explains what’s behind an innovative product catalog solution that doubles as a service creation environment for resellers in multiple tiers.

- Telecom Blocking & Tackling: Executing the Fundamentals of the Order-to-Bill Process — interview with Ron Angner — Just as football teams need to be good at the basics of blocking and tackling, telecoms need to excel at their own fundamental skillset: the order-to-cash process. In this article, a leading consulting firm explains its methodology for taking operators on the path towards order-to-cash excellence. Issues discussed include: provisioning intervals; standardization and simplicity; the transition from legacy to improved process; and the major role that industry metrics play.

- Wireline Act IV, Scene II: Packaging Network & SaaS Services Together to Serve SMBs — by John Frame — As revenue from telephony services has steadily declined, fixed network operators have scrambled to support VoIP, enhanced IP services, and now cloud applications. This shift has also brought challenges to the provisioning software vendors who support the operators. In this interview, a leading supplier explains how it’s transforming from plain ol‘ OSS software provider to packager of on-net and SaaS solutions from an array of third party cloud providers.

- Telecom Merger Juggling Act: How to Convert the Back Office and Keep Customers and Investors Happy at the Same Time — interview with Curtis Mills — Billing and OSS conversions as the result of a merger are a risky activity as evidenced by famous cases at Fairpoint and Hawaiian Telcom. This article offers advice on how to head off problems by monitoring key operations checkpoints, asking the right questions, and leading with a proven conversion methodology.

- Is Order Management a Provisioning System or Your Best Salesperson? — by John Konczal — Order management as a differentiator is a very new concept to many CSP people, but it’s become a very real sales booster in many industries. Using electronics retailer BestBuy as an example, the article points to several innovations that can — and are — being applied by CSPs today. The article concludes with 8 key questions an operator should ask to measure advanced order management progress.

- NEC Takes the Telecom Cloud from PowerPoint to Live Customers — interview with Shinya Kukita — In the cloud computing world, it’s a long road from technology success to telecom busness opportunity. But this story about how NEC and Telefonica are partnering to offer cloud services to small and medium enterprises shows the experience of early cloud adoption. Issues discussed in the article include: customer types, cloud application varieties, geographic region acceptance, and selling challenges.

- Billing As Enabler for the Next Killer Business Model — interview with Scott Swartz — Facebook, cloud services, and Google Ads are examples of innovative business models that demand unique or non-standard billing techniques. The article shows how flexible, change-on-the-fly, and metadata-driven billing architectures are enabling CSPs to offer truly ground breaking services.

- Real-Time Provisioning of SIM Cards: A Boon to GSM Operators — interview with Simo Isomaki — Software-controlled SIM card configuration is revolutionizing the activation of GSM phones. The article explains how dynamic SIM management decouples the selection of numbers/services and delivers new opportunities to market during the customer acquisition and intial provisoining phase.

- A Cynic Converted: IN/Prepaid Platforms Are Now Pretty Cool — interview with Grant Lenahan — Service delivery platforms born in the IN era are often painted as inflexible and expensive to maintain. Learn how modern SDPs with protocol mediation, high availability, and flexible Service Creation Environments are delivering value for operators such as Brazil’s Oi.

- Achieving Revenue Maximization in the Telecom Contact Center — interview with Robert Lamb — Optimizing the contact center offers one of the greatest returns on investment for a CSP. The director of AT&T’s contact center services business explains how telecoms can strike an “artful balance” between contact center investment and cost savings. The discussion draws from AT&T’s consulting with world class customers like Ford, Dell, Discover Financial, DISH Network, and General Motors.

- Mobile Broadband: The Customer Service Assurance Challenge — interview with Michele Campriani — iPhone and Android traffic is surging but operators struggle with network congestion and dropping ARPUs. The answer? Direct resources and service quality measures to ensure VIPs are indeed getting the quality they expect. Using real-life examples that cut to the chase of technical complexities, this article explains the chief causes of service quality degradation and describes efficient ways to deal with the problem.

- Telco-in-a-Box: Are Telecoms Back in the B/OSS Business? — interview with Jim Dunlap — Most telecoms have long since folded their merchant B/OSS software/services businesses. But now Cycle30, a subsidiary of Alaskan operator GCI, is offering a order-to-cash managed service for other operators and utilities. The article discusses the company’s unique business model and contrasts it with billing service bureau and licensed software approaches.

- Bricks, Mortar & Well-Trained Reps Make a Comeback in Customer Management — interview with Scott Kohlman — Greater industry competition, service complexity, and employee turnover have raised the bar in the customer support. Indeed, complex services are putting an emphasis on quality care interactions in the store, on the web, and through the call center. In this article you’ll learn about innovations in CRM, multi-tabbed agent portals, call center agent training, customer treatment philosophies, and the impact of self-service.

- 21st Century Order Management: The Cross-Channel Sales Conversation — by John Konczal — Selling a mobile service is generally not a one-and-done transaction. It often involves several interactions — across the web, call center, store, and even kiosks. This article explains the power of a “cross-channel hub” which sits above all sales channels, interacts with them all, and allows a CSP to keep the sales conversation moving forward seamlessly.

- Building a B/OSS Business Through Common Sense Customer Service — by David West — Delivering customer service excellence doesn‘t require mastering some secret technique. The premise of this article is that plain dealing with customers and employees is all that’s needed for a winning formula. The argument is spelling out in a simple 4 step methodology along with some practical examples.